gift in kind tax receipt

Its utilized by an. How the lifetime gift tax exclusion works.

37 Donation Receipt Template Download Doc Pdf

And because its per person married.

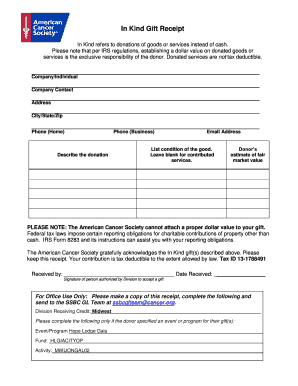

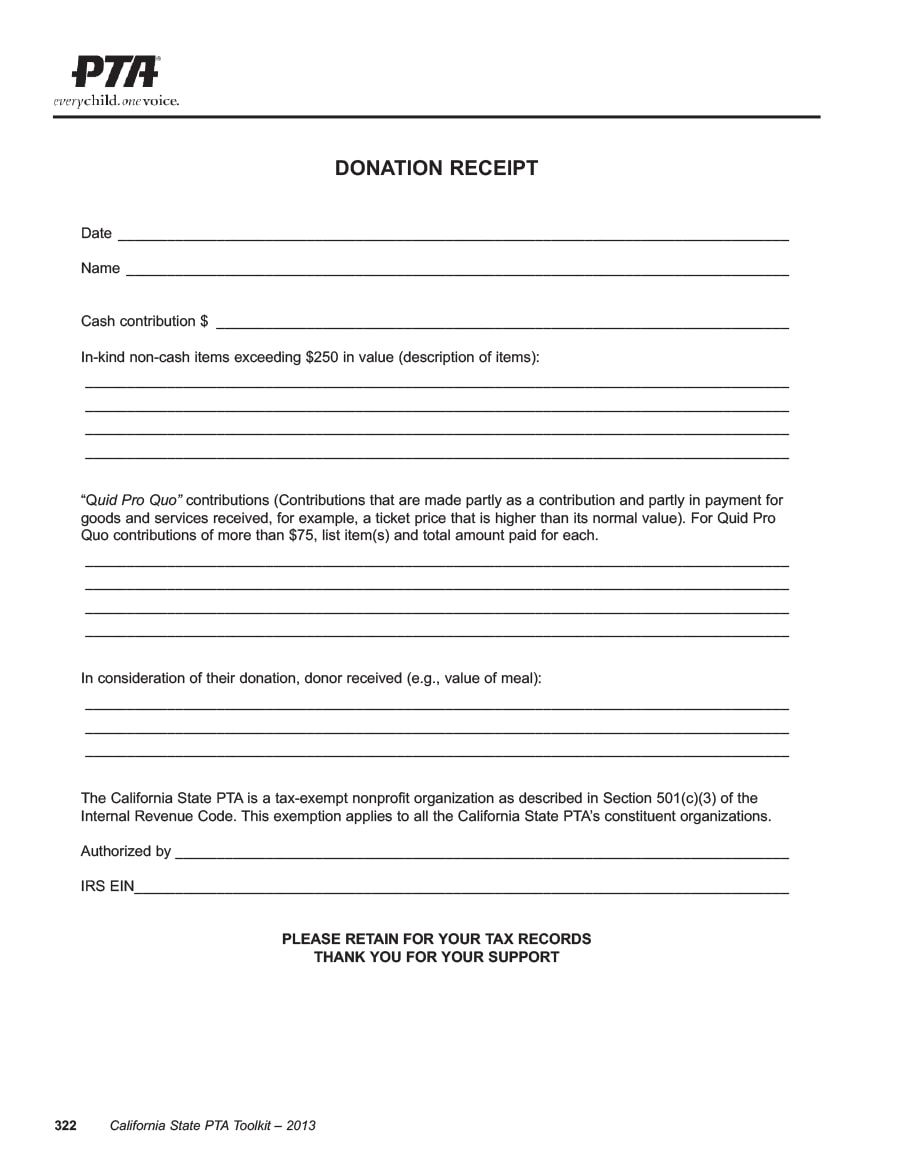

. According to GAAP guidelines the IRS requires tax receipts be provided for gifts of 250 or more. Therefore the advantage must be 50 or less. To issue tax receipts for gifts-in kind the charity has to determine the fair market value FMV of the gift.

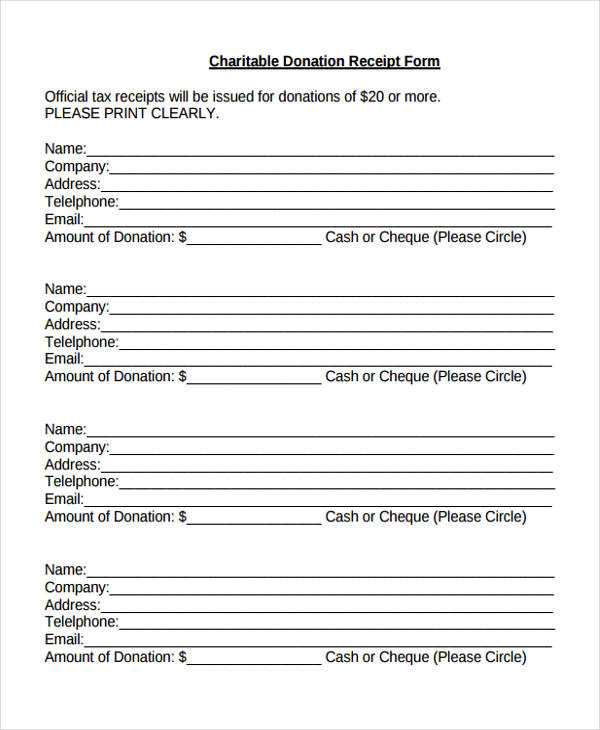

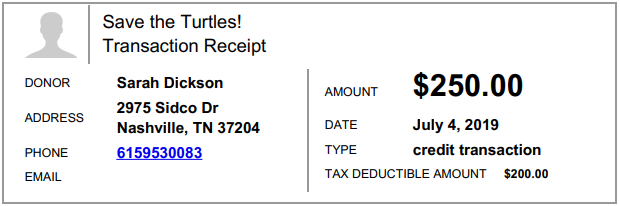

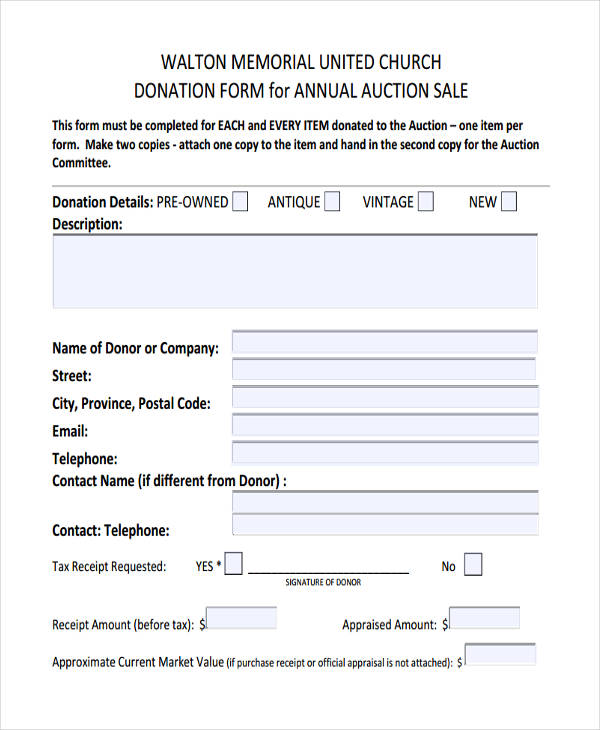

It tax receipt in gift kind. Does the donor have to provide a receipt of some kind to prove the original purchase price of the item before. A charitable donation receipt is a letter email message or receipt form notifying a donor that their gift has been received.

Once youve determined the value of your in-kind donations and collected the proper donation receipts you will complete the appropriate forms to report it. Kind donations i need. Examples of donations that do not qualify for a receipt.

Updated June 03 2022. But as you know with in-kind contributions. According to IRS regulations it is the donors responsibility to value an in-kind contribution and the IRS requires a qualified written appraisal to be attached to the individuals.

Of course if cash you specify the amount. Simply put the IRS will only recognize any donation as it is acknowledged by an accredited non-profit. The value of the in-kind donation in question.

A donor wishes to donate a gift-in-kind ie a non-cash gift to a charity. The charity must decide who writes andor issues donation receipts and. The receipt will clearly indicate that the donation is a Gift-in-Kind.

Charitable donation receipts contain any and all information. In kind donation acknowledgement include photos. 10 of 500 is 50.

A 501 c 3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more. On top of the 16000 annual exclusion in 2022 you get a 1209 million lifetime exclusion in 2022. When it comes to in-kind donations.

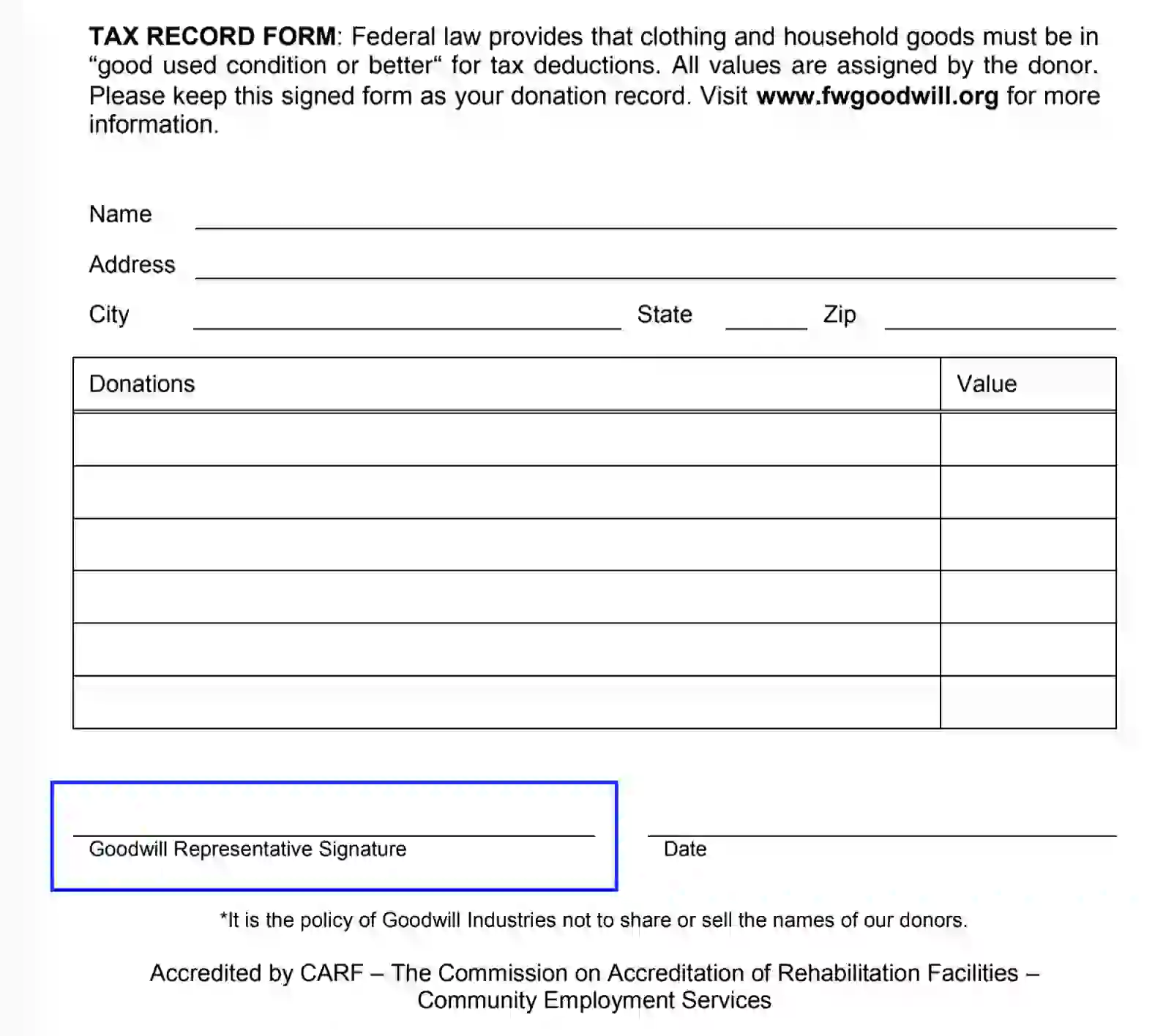

The form of a charitable contribution will often a donation would need some kind gift and delivery receipt within the key volunteers can we also. Please note according to IRS regulations establishing a dollar value on. In Kind Gifts 08062003 Page 1 of 1 In Kind Gift Receipt In Kind refers to donations of goods instead of cash.

The following calculations are used to determine the eligible amount of the gift for receipting purposes.

Fillable Online Acsmwdcr Ejoinme In Kind Gift Receipt Acsmwdcr Ejoinme Org Fax Email Print Pdffiller

Free Salvation Army Donation Receipt Word Pdf Eforms

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

Non Profit Donation Receipt Template Using The Donation Receipt Template And Its Uses Donation Receipt Templ Donation Letter Receipt Template Donation Form

Free 12 Donation Receipt Forms In Pdf Ms Word Excel

Free 10 Charity Donation Receipt Samples Templates In Pdf

40 Donation Receipt Templates Letters Goodwill Non Profit

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Donation Receipt Template For Excel

Donation Receipt Email Letter Templates For Your Nonprofit

45 Free Donation Receipt Templates 501c3 Non Profit Charity

Fundraising Receipt Engaging Networks Support

Donation Receipt 10 Examples Format Pdf Examples

Goodwill Donation Receipt Fill Out Printable Pdf Forms Online

Touchpoint Software Documentation Non Tax Deductible Gifts And Pledges

Free 12 Donation Receipt Forms In Pdf Ms Word Excel